- This article is a reply to three articles written by Nairametrics contributors on insurance companies, Ensure, Wapic and AIICO

- The Nairametrics article mostly focused on operating expenses of these companies

- This article however attempts to focus the mind of investors on what it believes should be the major indices to look out for when analysing Insurance Companies

I have read with interest, your independent analysis and opinion on recently published financial reports of some insurance companies, from Ensure Insurance Plc to Wapic Insurance Plc, and AIICO Insurance Plc.

Indeed, you have done very well in drawing public attention to the industry, particularly the retail investors, where you and I belong. I believe such write-ups can only invigorate the insurance industry by strengthen investor activism and thereby strengthen corporate governance.

As I work in financial reporting and performance management in one of the leading insurance companies here in Nigeria, I consider it part of my professional responsibility to contribute to objective discussions and analysis, and interpretations thereof, of the financial statements of insurance companies.

For example, when you wrote “Ensure Insurance Spent 80% of Revenues on Expenses” or the more intense “8 Bogus Expenses suggests why Wapic shareholders may be stuck at 50kobo” in the published articles of March 21 and March 12 respectively, I can only see the need for me to write this article and clarify some fundamental key performance indices (KPIs) used to appraise performance in the insurance industry.

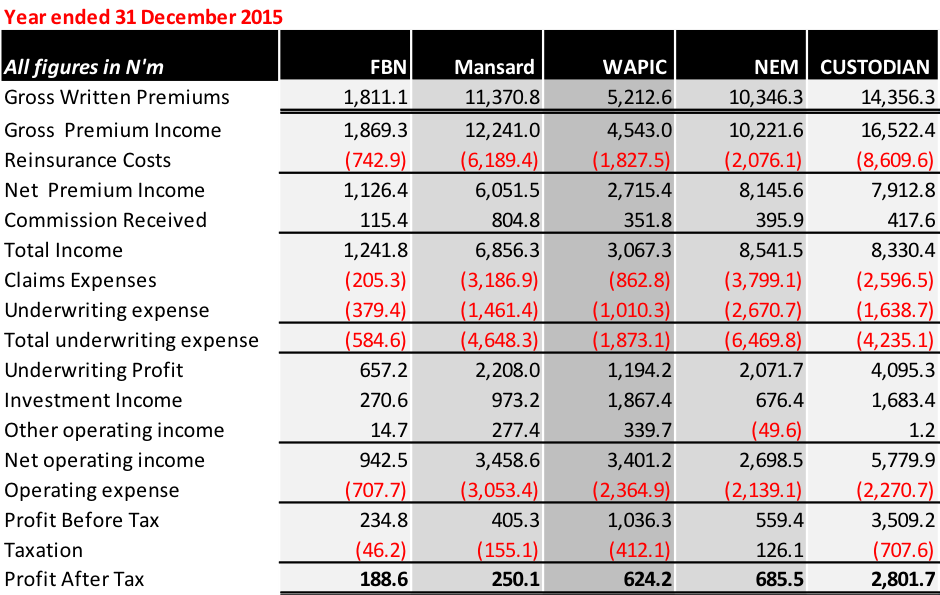

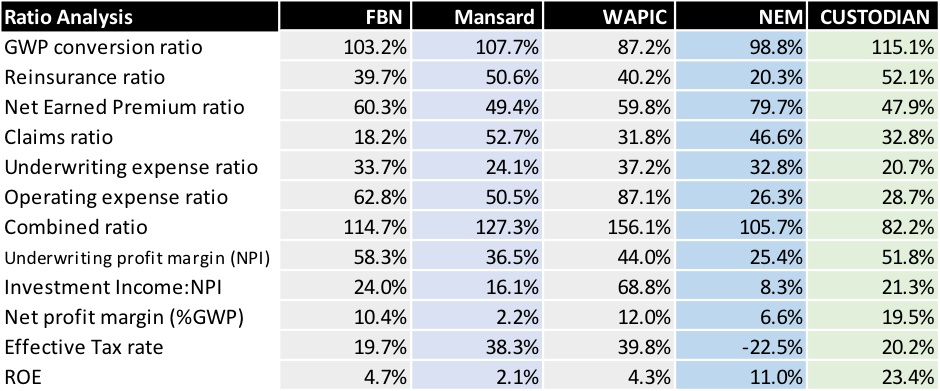

The term revenue could mean one of two KPIs in the insurance industry; Gross Written Premium (GWP) or Gross Premium Income (GPI). As the names imply, the former represents the whole premium underwritten in the reporting period, while the latter is the earned premium income in the same reporting period. The major difference between these KPIs is the term referred to as unearned premium or technically as unexpired risk premium. To a lay man, this is the portion of the written premium belonging to a future period.

Insurance companies compete for GWP, the market share of each insurance company is determined by the ratio of their GWP relative to the entire market.

Insurance is the business that must exist to guarantee the existence of other businesses. Insurance is therefore the house of risks! Insurance companies must determine their risk appetite, that is, they must decide the portion of the written risks they will retain, or rather transfer to other insurance companies (hence the existence of reinsurance companies also) as part of their risk management strategy significant effect on the bottom line.

Insurance companies buy this protection (or capacity) by sharing part of the GPI with the reinsurance company (called the reinsurer) by paying out what is called reinsurance premium to the reinsurer. The GPI defined above, is therefore reduced to Net Premium Income (NPI) by the singular item called reinsurance expenses.

Using the recently published 2015 yearend Financial Statements for the General insurance business, Custodian and Mansard Insurance spent 52.1% and 50.6% of their GPI as reinsurance expenses respectively, compared with 20.3% and 39.7% at NEM and FBN Insurance respectively.

Mansard and Custodian may be described as more conservative, while NEM Insurance as “aggressive” or displaying a higher risk appetite. It’s important to express absolute numbers as a ratio of another KPI, doing this bring about their relationships and often disclose management strategy or policy objectives. It further reveal efficient and good management among operators.

Afolabi Lawal works within the Finance Function of AIICO Insurance Plc, he is an avid reader and a contributor on nairametrics.