Getting a loan in Nigeria typically requires a few steps, especially if you are credit worthy. For prior borrowers and non-defaulters, it is as easy as going back to your bank and asking that they extend you a new loan. If you are a salary earner, you will only be expected to tender your payslips, domicile your salary with the bank (if you have not done that), write an application and fill a few forms.

For more on how to get a bank loan, you can read it here.

These days the challenge with loans in Nigeria is less of getting the loans but more about the cost of these loans. In Nigeria, lending rates range from between 20% to 30% depending on the bank, your rating with the bank and perhaps which organisation you work. So, should you wish to get a loan from a commercial bank in Nigeria, the following terms are applicable.

Your name: Wale Nnamdi Adamu

Type of loan: For example, Personal Loan

Loan amount: Amount you are borrowing

Tenor: 48 months

Interest Rate: Between 24% – 30% per annum

Management Fees: 1.00 % flat on facility amount (to be collected upfront)

Commitment Fees: 1.00 % flat on facility amount (to be collected upfront)

Insurance: 1.00 % flat on facility amount (to be collected upfront)

Value Added Tax (VAT): 5.00% flat on Management and Commitment Fees (to be collected upfront). They basically charge you VAT on the 1% Management and Commitment Fees respectively.

Repayment Terms: Whether it is monthly, quarterly and in what instalment

Repayment Method: Direct debit to domiciled salary account

Collateral: Irrevocable domiciliation Of Salary

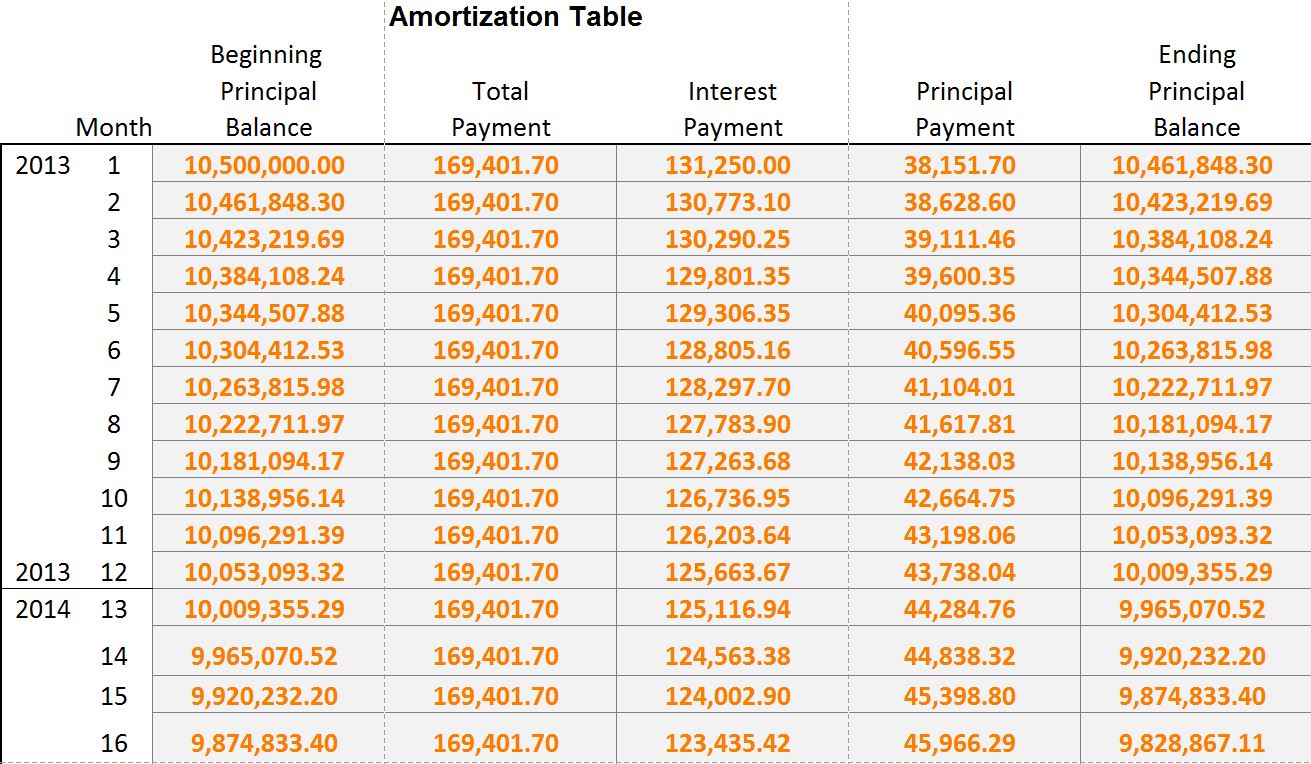

In case you are wondering what, this means in monetary terms. This table here can help you understand how much you will be charged in the first year. This of course excludes interest rates.