Commercial Banks in Nigeria still charge the N50 stamp duty despite a court ruling that confirms it is illegal. Earlier in the year, the Federal Government had relied on provisions in the Stamp Duty Act of 2004 to charge customers a flat N50 on deposits made into their bank accounts.

However, a court ruling last month rendered the tax illegal confirming that the act does not include electronic deposit of cash into bank accounts. In a ruling delivered earlier in November Iby an Appeal Court panel of Justices Ejembi Eko, Adamu Jauro, Moore Adumein and Nonyerem Okoronkwo, they agreed on an appeal filed by Standard Chartered Bank against Kasmal International Services Limited and 22 others that the duties were illegal.

“However, I would want to agree with the submission of the appellant that in the absence of any express provision to the contrary, (by way of amendment of the Stamp Duties Act) the provisions of the schedule of the Stamp Duties Act, especially item four clearly show that the documents, which evidence receipt of monetary deposits by a bank, such as the appellant, are exempted from the payment of stamp duties.

“As such, there is no obligation thereupon to deduct and remit stamp duties on deposits or transfers, either as erroneously found by the court below, or at all. And I so hold.”

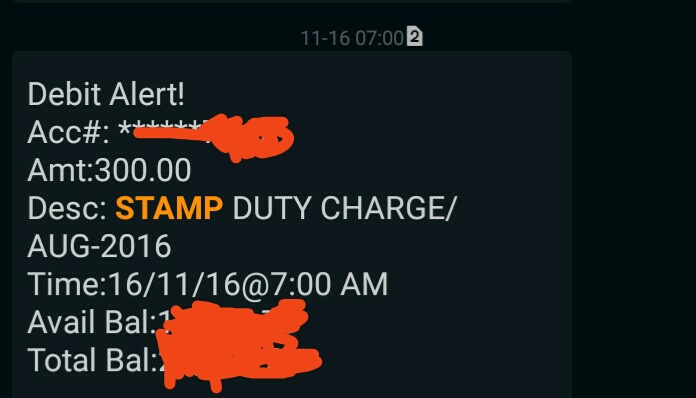

Despite this ruling, some banks are still charging stamp duty. Here is a screenshot of an alert from a bank account recently debited for Stamp Duty.

Why are they still charging?

Indications suggest it could be either of two reasons. Firstly, is the slow attitude towards implementing court ruling especially when it has to do with tax. Banks are apparently afraid to fall under the wrath of the FG and will rather not err on their side but on the side of their customers. We also believe, they are yet to obtain a directive from the government or CBN instructing them to stop deducting.

Another reason could be that the government is about to amend the act to allow it accommodate electronic transactions. This could take month’s if not years and is likely to face massive revolt from citizens tired of being “over taxed” with little or nothing to show for it.

What is TBC or THE BILLION COIN? It is a crypto currency or internet currency/money use to buy any product or services to co member of TBC or to the TBC community around the world. The value of TBC is increasing every day from 1-5%, it never goes down because its value is based on the number of new verified members. The number of member always goes up it never goes down.. If you buy 100 TBC today after 1 month your 100 TBC is already worth 1 million or more. If you buy 50 TBC today in 1 year and 3 months it is already worth 1 million or more. If you buy 25 TBC today after 6months it is already worth 1 million or more. If you buy 10 TBC after 1 year it is already worth 1 million or more. The price rate as at Monday 31st October was N22,000 while on Tuesday 29th November it’s at N73,980. You see the price always goes up.. If you are really interested in becoming a stakeholder am offering a discount price of N15,000 if you buying lass then 10 coin and N10,000 if you are buying more than 10. Since I started selling at this rate buyers are rushing it. Hurry now before the price change. For Enquiry Whatsapp or call us on 08165396851